Spend on private LTE/5G networks will be small but an important opportunity for future IoT growth

The private LTE/5G network market is in its infancy; fewer than 1000 networks have been deployed but early trends indicate that the market will grow quickly. We forecast that the market will exceed 20 000 networks by 2026 and enterprise spend on these networks will reach USD5 billion in 2026. Spend on private LTE/5G networks will be small, less than 10% of what will be spent on public LTE and 5G networks in the next 5 years. However, it could provide an important opportunity to support new IoT use cases in indoor and campus environments and expand the addressable market for IoT services based on cellular technologies.

The forecast data in this article is from our newly published private networks forecast report, which includes forecasts by region and by vertical market.

Spend on private networks will build slowly as challenges to adoption are addressed

Demand for private LTE/5G networks will continue to grow, but we expect that growth to result in a steady increase in the number of networks rather than an explosion of activity. A few factors will restrain demand.

- Long replacement cycles in target markets: the pace of change is sluggish in many industries. For example, the estimated life of a factory is 20 years; this constrains the speed at which private LTE/5G and other new technologies are deployed.

- Brownfield sites with a complex technology environment make integration challenging: most industrial environments are brownfield sites; they already have a plethora of networking technologies in place. Installing new, additional technologies can be complex and costly. Businesses will not rush to adopt new private network technology given this complexity and cost.

- Bespoke requirements restrict potential economies of scale: the market is highly bespoke. Sector requirements are diverse and enterprise needs vary even within sectors. Custom requirements add cost and create barriers to scale.

- High cost: the cost of private LTE/5G networks is high compared to alternatives such as Wi-Fi. Only a relatively large enterprise can afford to deploy them. Small and medium-sized enterprises (SMEs) and some verticals are largely excluded due to cost and complexity.

- Lack of common spectrum across countries: A multinational enterprise that wants to deploy a private LTE/5G network across sites in different countries will have to work with factors that vary by country such as spectrum, regulation, pricing points and deployment models, and may also face interoperability issues. Spectrum regimes are fragmented and include licensed, shared and unlicensed spectrum options. Broader availability of spectrum could generate more demand for private networks but could also result in problems of complexity and scale.

Spend on private networks will be small but operators will want a share of it because it will be critical for future IoT services

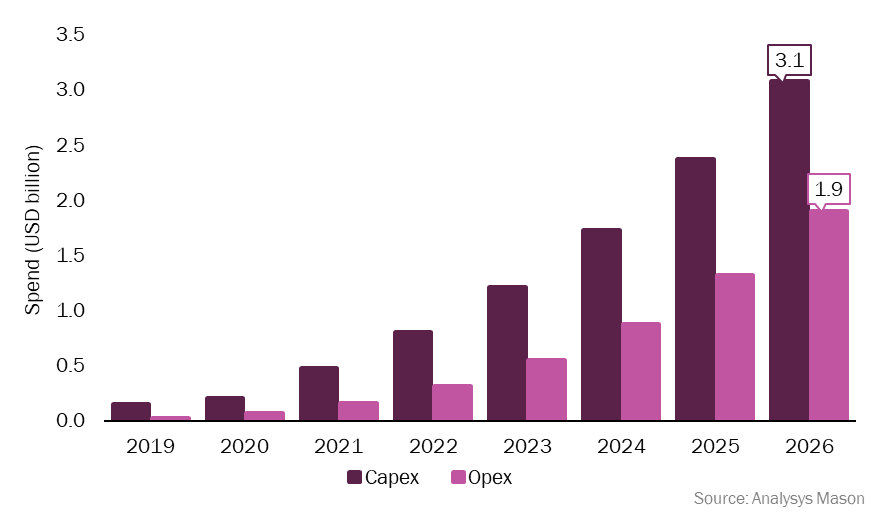

We forecast that private LTE/5G network capex will grow from around USD208 million in 2020 to USD3.1 billion in 2026. This figure includes radio access and core network infrastructure costs, but excludes spectrum. Spend on private networks is therefore small compared to total mobile capex for public networks. Analysys Mason’s forecast for public mobile capex is USD170 billion in 2026. The figures are not directly comparable because the public networks figure includes spectrum costs, but it illustrates the relative sizes of the private and public cellular networks. Similarly, opex generated by private cellular networks will be small in 2026 (USD1.9 billion) compared to total mobile opex (USD400 billion). Again, definitions differ but the public networks opex provides context for the size of the private LTE/5G market.

Figure 1: Private LTE/5G network spend by type, worldwide, 2019–2026

The IoT market provides a valid point of comparison. It has taken longer than a decade to reach annual connectivity revenue of USD8.5 billion in 2020 and it still accounts for less than 1% of mobile revenue for most operators. In the next 5 years, private LTE/5G will represent a useful source of additional revenue for telecoms operators and network equipment vendors. For telecoms operators, private networks will probably add less than 1% to mobile revenue. This is small in percentage terms, but for the larger operators it could mean tens of millions of dollars in additional revenue. Private networks will not transform the business for operators or vendors, but the potential benefit is not insignificant.

However, capturing a share of the private LTE/5G networks will be critical to targeting the in-building opportunity for operators that place IoT at the heart of their growth strategy. Delivering services and solutions that generate more value than connectivity will be an important driver for operators in the private networks market. Providing the network and spectrum is a possible entry point for selling other hardware and solutions such as mobile edge computing, cloud services, professional services and data analytics. However, a note of caution is in order. Most operators have not been successful in delivering value-added services to enhance their wide-area connectivity offers and will face similar challenges with private networks.

Article (PDF)

Download